ProTraderStrategies Academy presents:

The PTS Strong Stock Ranker and Scanner

-Finding High Quality Stocks

Reg: $995

Early-Bird Price: $495 (Save $500)

*Sign up Now and New Members Get 12 months FREE on PTS Primo Charts

VIDEO #1-Using PTS Strong Stock Ranker with your portfolio or watchlist

VIDEO #2- An Intro To PTS Strong Stock Scanner

Add Content Block

1) Learn To Easily Find The Strongest Trending Stocks In The Market

Most traders buy off news or emotion. They don’t bother to look if a stock is in an up or downtrend or if its ready to breakdown. We will teach you how to easily scan for only the strongest stocks in the market with a simple click of the mouse.

2) Get Access Instant Access To The PTS Strong Stock Ranker Scanner

This scanner will easily help you scan the entire universe of US stocks and see which ones are the strongest, which ones are improving and which ones are weakening.

3) Learn To Easily Filter Out Weaker Stocks

We will teach you the simple rules you should apply to weed out stocks that should not be on your watch list let alone in your portfolio.

4) How To Find Stealth Stocks Moving Under The Radar

You will never guess which stocks are doing the best in this market. Most of the time traders/investors have no clue which stocks are outperforming the market simply because they aren’t being reported on. You will be amazed to see which stocks have been in “stealth” Rally Mode without you even knowing about it. Hint: They are well known brand names

5) Learn How To Easily Find Weak Stocks In The Market

You will never guess which stocks have been getting crushed in this market. Most of the time traders/investors have no clue which stocks are getting hammered in the market simply because they aren’t being reported on. You will be amazed to see which stocks have been in “STEALTH” Crash Mode without you even knowing about it. Hint: They are well

6) Learn How To Find Beaten Down Stocks Which Potentially Bottoming Out

Find the stocks which have sold off and the pattern to look for when they appear to be bottoming out to find potentially higher reward setups.

And more features coming soon….

*Buy now and get all new feature upgrades for FREE!

Lesson #1: How do you weed through 10,000’s of stocks to find high quality candidates to Trade?

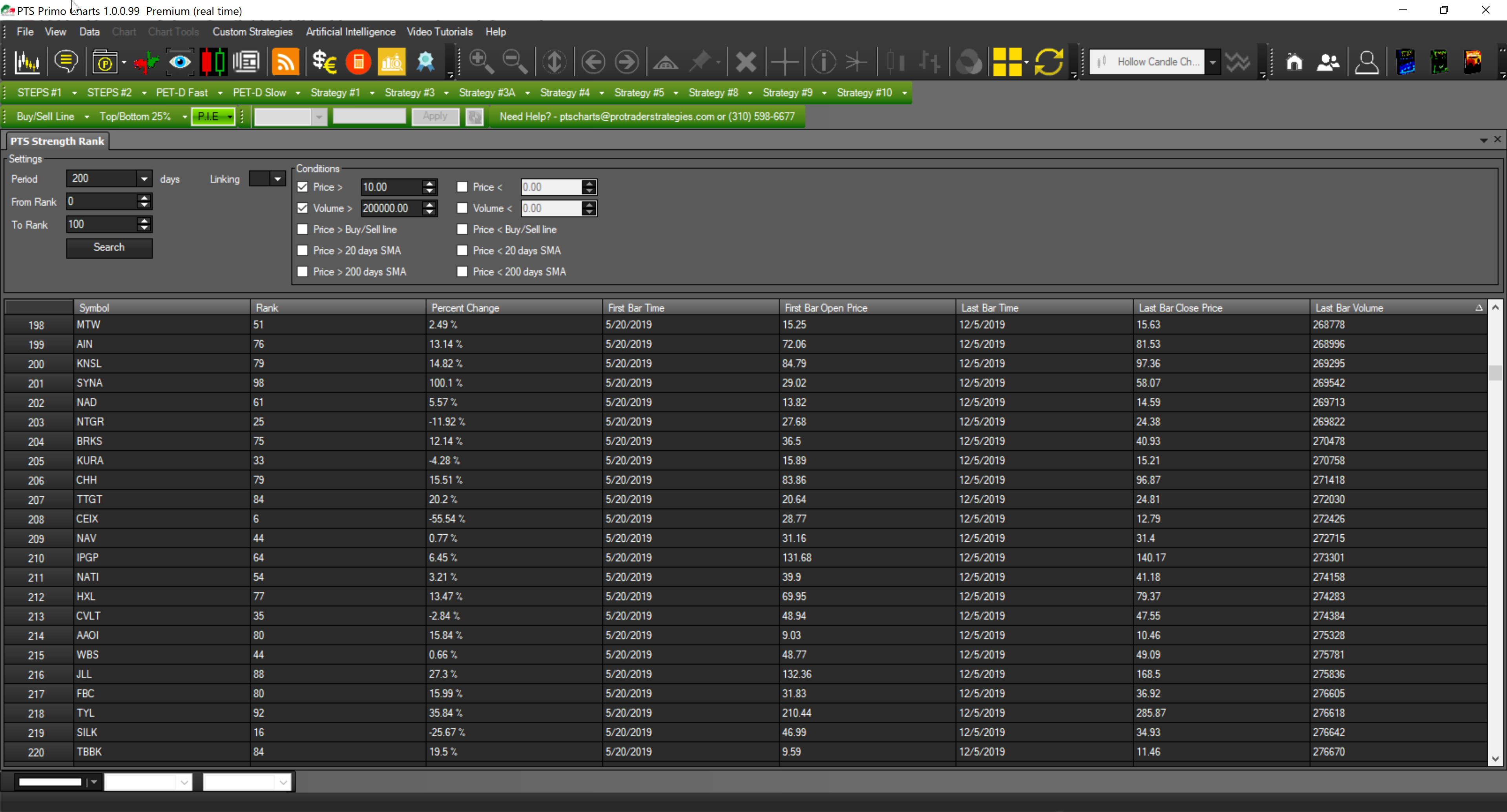

STEP 1:Open Your PTS Strong Stock Rank Scanner

STEP 2:Pull up all stocks ranked between 1-100.

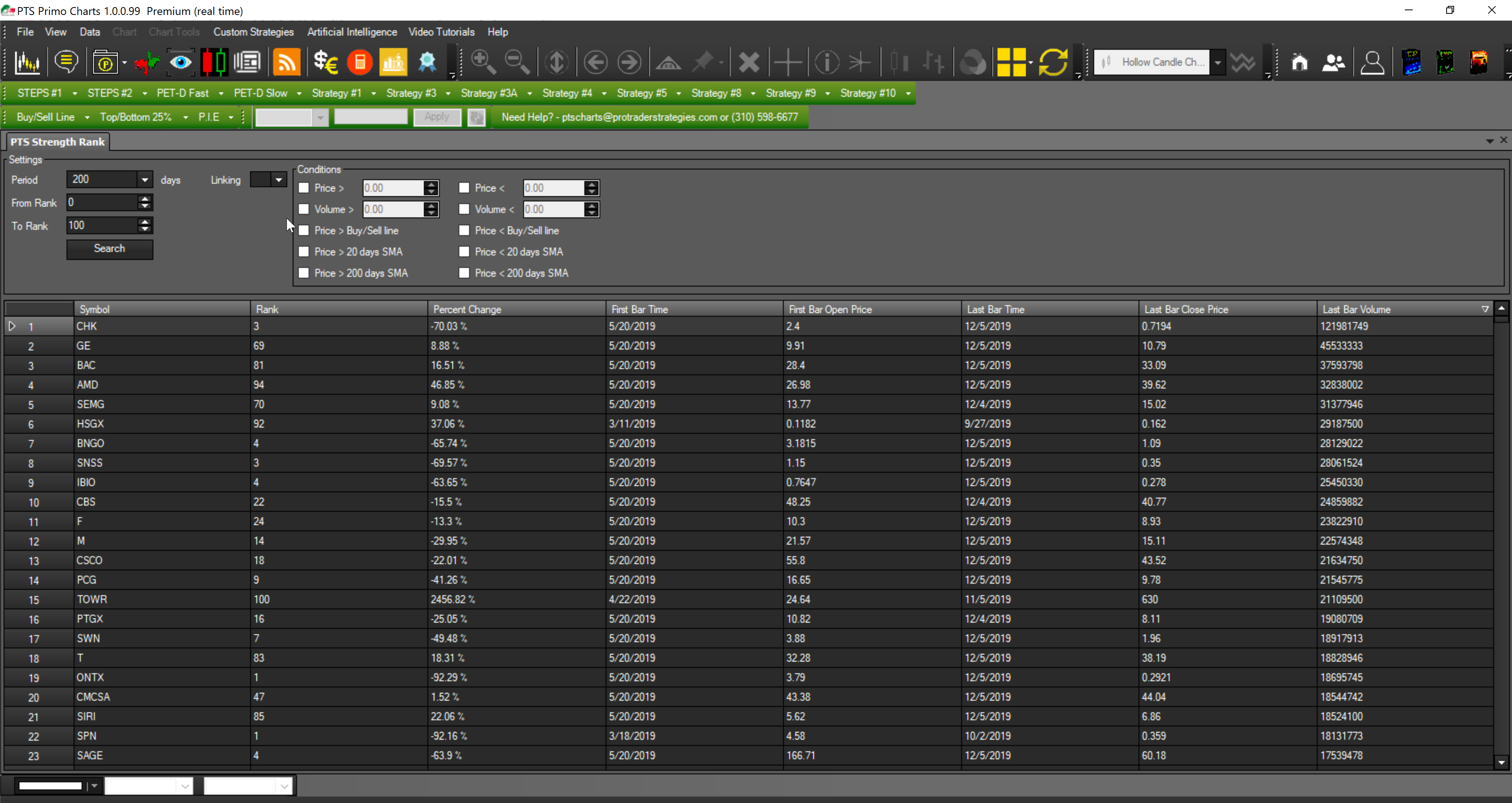

Now you can see all stocks ranked based on their strength and how they performed vs eachother

Still so many stocks but now we can see which ones are the weakest and which ones are the strongest

STEP 3: Let’s filter out some of the weaker stocks. How do we do that? By using the filter conditions in image below…

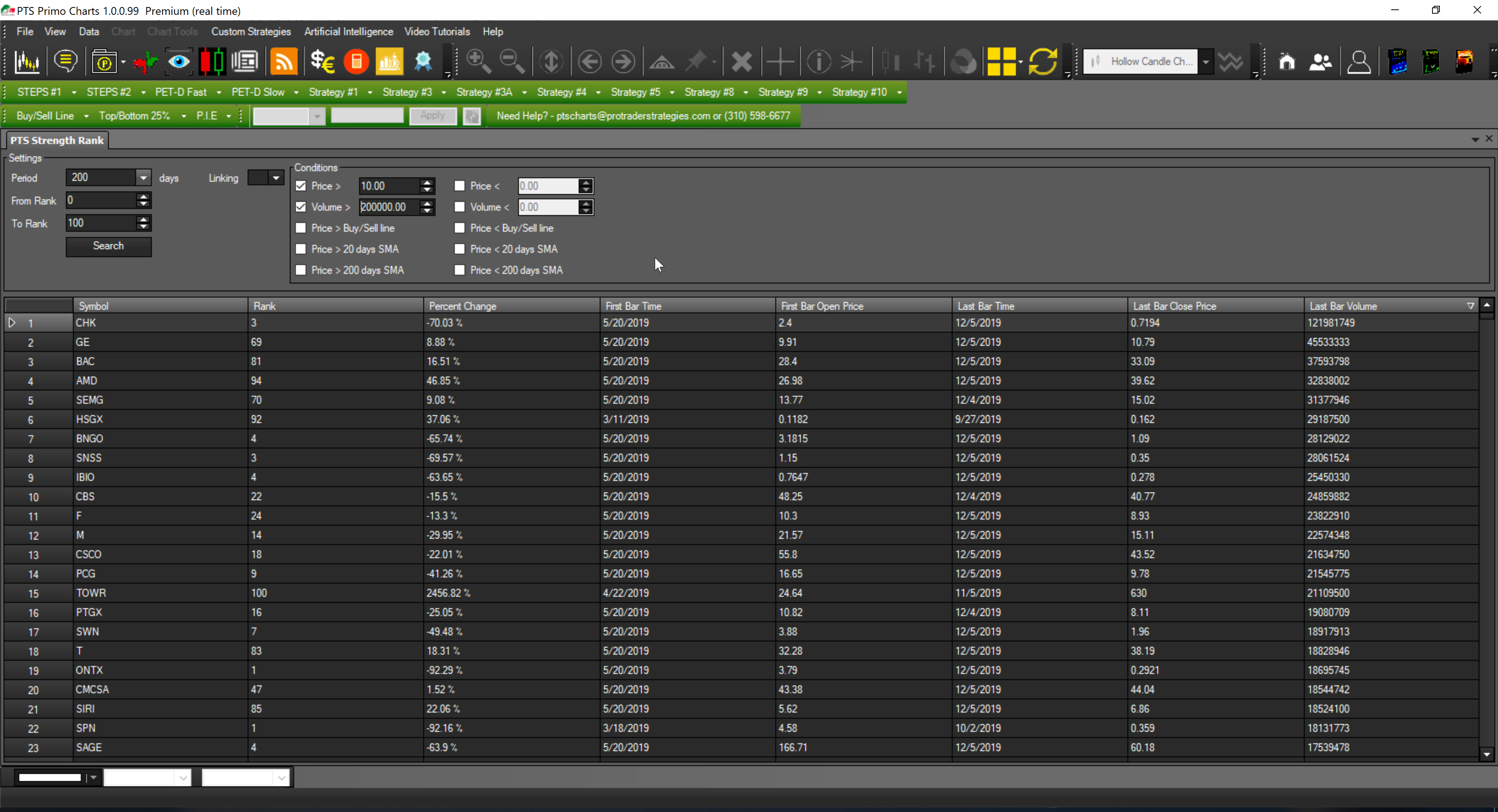

Filter #1:Let’s start by choosing stocks with a price above $10.

Filter #2: Next lets get rid of the less liquid stock symbols which don’t trade much or at all. You can do this by choosing volume greater than 200,000 as an example.

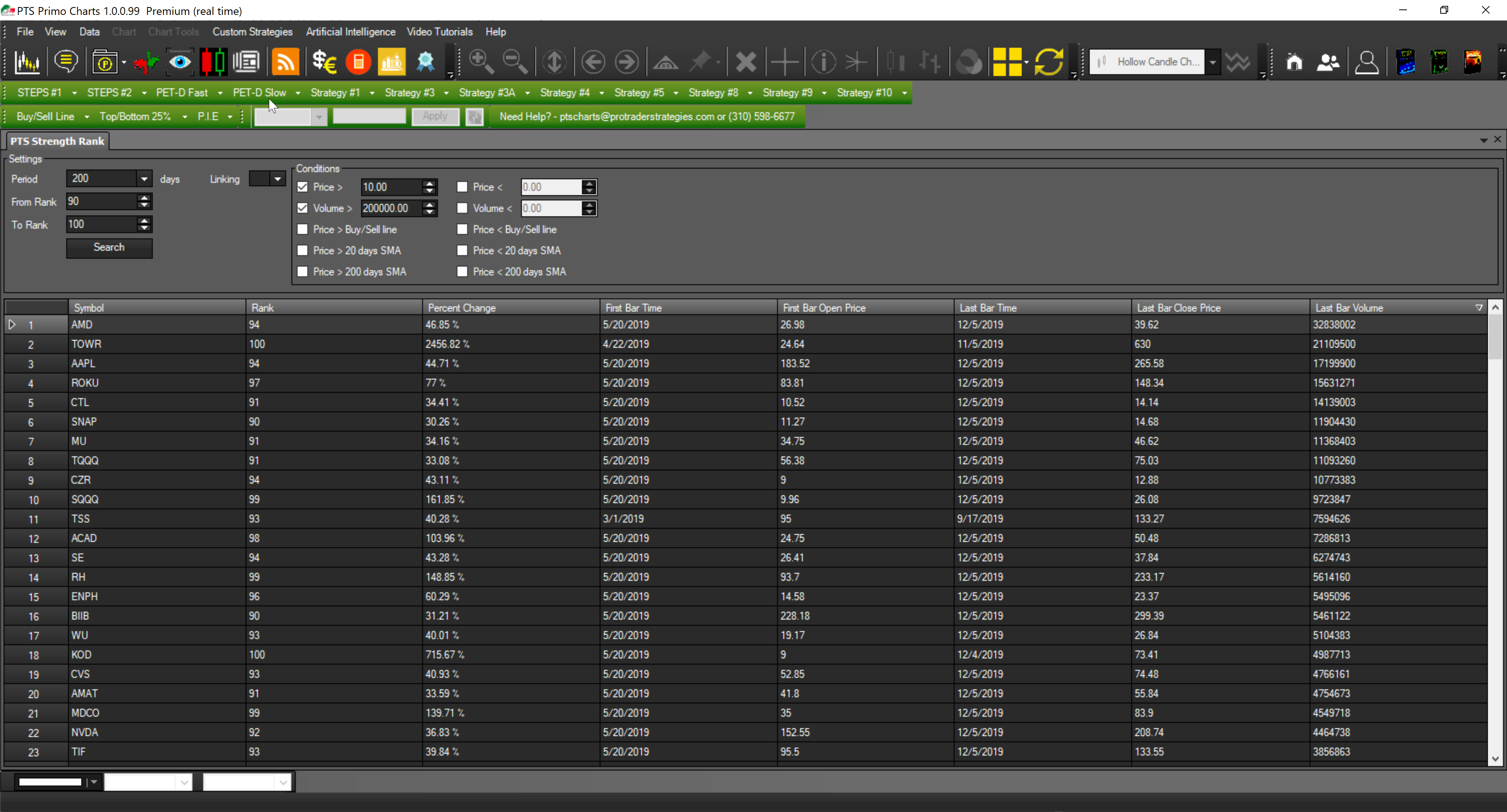

Now we have a list of 1650 stocks but these are both strong and weak stocks. Lets select stocks ranking between 90-100 to get the strongest 10%

Filter #3: Select a rank between 2 numbers such as Rank 90-100. This gives us an even more refined list of only a couple hundred stocks

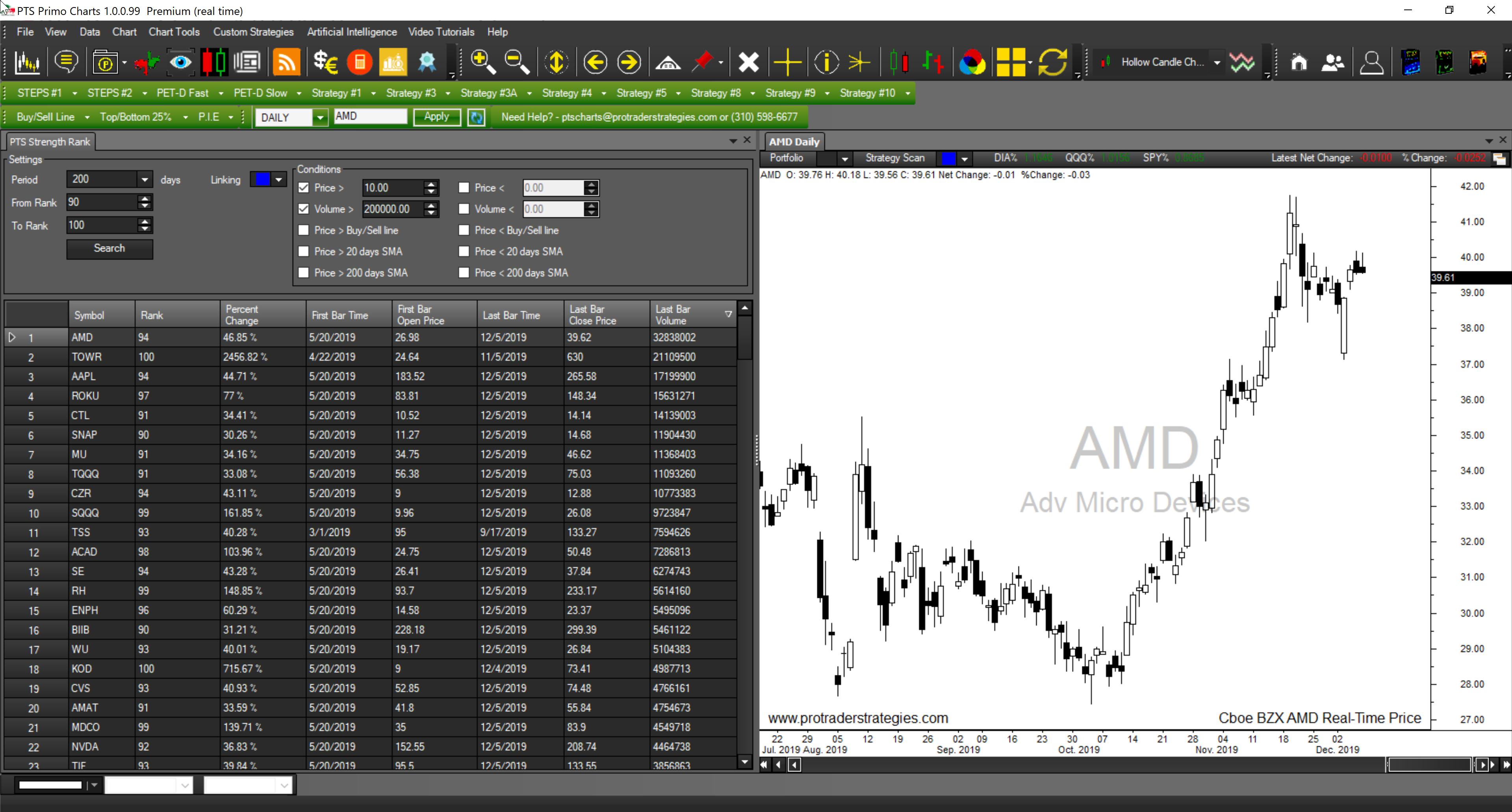

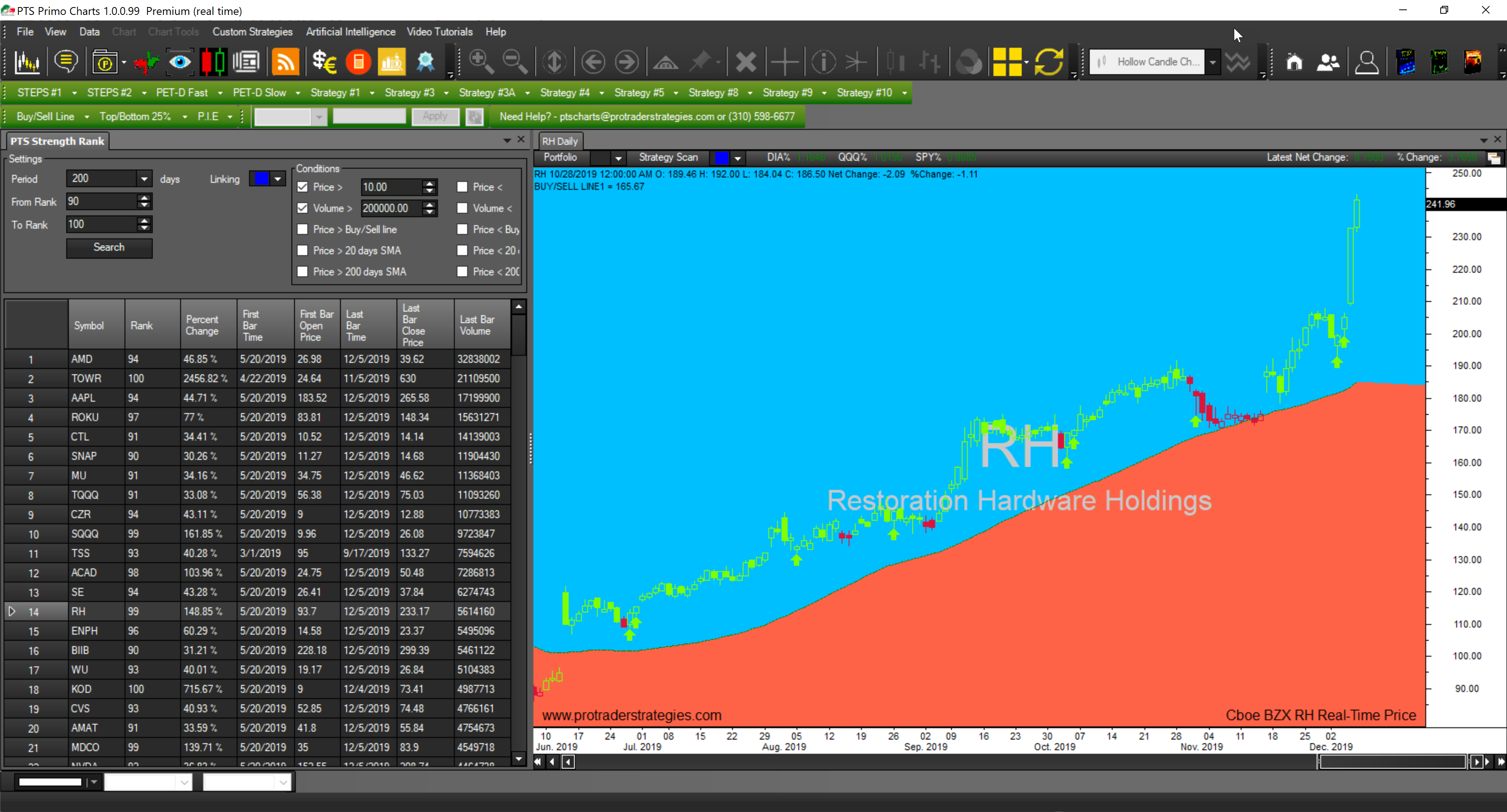

STEP 4: Double click a symbol to automatically open chart. Select side by side layout configuration to see chart side by side with scanner. Select blue color or same color on linking and strategy scan. Now you can use your space bar to cycle through charts

STEP 5: Add additional filters, some of Steven Primo’s strategies, the PETD or your own analysis tools to the charts.

STEP 6: The default to watch is the 200 day however you can select the 5, 20, 50 or 100 day time frames to see what is strongest over these shorter time periods. Strong stocks over the 5 or 20 day time periods may be older weak stocks now bottoming out and getting ready for a stealth move higher. Now that you can scan for them every day or week these stocks wont get by you ever again…

You can then start to save a high quality watch list which is half teh battle. Now just wait to time your entries using your favorite trading strategies and you will be amazed at how much confidence you now have in your daily routine.

*This was an introductory walk through to the PTS Strength Rank Scanner. For more information on using these tools as well as advanced more settings and training signup for the PTS Strength Rank Course and Scanner by clicking here

About ProTraderStrategies Academy

The Builders of Pro Trader Strategies and PTS Primo Charts have a combined market and trading experience of nearly 100 years. Having been active participants in the markets as well as learning under some of the best legendary investing minds of our time. Our goal is to pass along the market knowledge and wisdom we have discovered through our journey of investing.

Most investors are given mixed messages or just plain bad information altogether which has led them to become frustrated and unsuccessful in the markets. It is our goal to help investors take the emotions out of their trading decisions, help them drown out all the useless opinions from so called experts and give them an easy to follow roadmap they can follow on their own to finally gain the confidence to make their own educated decisions.

The ProTraderStrategies Academy takes the highest quality investing education and has formatted it directly on your charts through PTS Primo Charts. This allows for an easy to follow and seamless integration between what you learn and easily apply and practice what you learned right on your charts through our automated features.

Contact us at 310 598-6677 or [email protected]