(Video) Swing Trades With Options -Sideways Moves- #3. Long Call Butterfly

Secrets Of Finely Tuned Entry Points – Part 2

In this follow up to last week’s educational discussion, Mr.… Read the rest

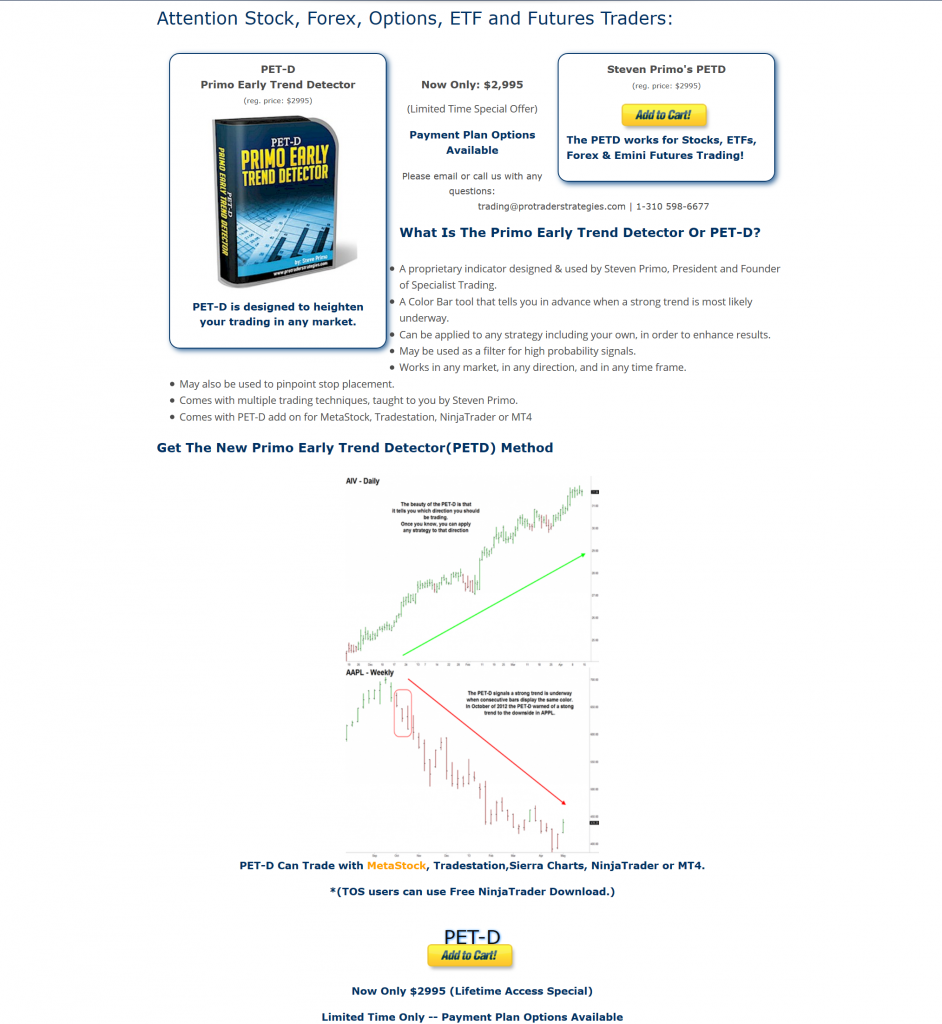

(Video) Steven Primo’s Your Search For A Great Trading Technique Ends Here

Spotting the Trade in $DIA $UPS $XLU $GLD w/ Eric “The Wolfman” Wilkinson 08/09/21

Your Search For The Perfect Trading Technique Ends Here

Many trading methods work great until the market decides to change directions.… Read the rest

(Video) Steven Primo’s Secrets Of Finely Tuned Entry Points – Part 1

Spotting the Trade in $BAC w/ Eric “The Wolfman” Wilkinson 08/06/21

Swing Trades With Options -Sideways Moves- #3. The Long Call Butterfly

The Long Call Butterfly is an option strategy that profits when the stock, ETF or Future stays within a tight trading range (Market Neutral Assumption) or migrates higher (slightly Bullish Market Assumption) to a price location the trader or investor believes to be a target.… Read the rest

(Video) Swing Trades With Options -Sideways Moves- #2. Short Iron Butterfly

Secrets Of Finely Tuned Entry Points – Part 1

Ask yourself this question: how is your trading going?… Read the rest

(Video) Steven Primo’s How To Identify Markets Just Days Before They Breakout

How To Identify Markets Just Days Before They Breakout

Spotting the Trade in $NKE w/ Eric “The Wolfman” Wilkinson 08/02/21

Spotting the Trade in $LVS w_/ Eric “The Wolfman” Wilkinson [07/30/21]

(Video) Swing Trades With Options -Sideways Moves- #1. The Shor Iron Condor

(Video) Steven Primo’s Finding Extreme Moves Doesn’t Get Any Easier Than This

Swing Trades Using Options -Sideways Moves- #2. Short Iron Butterfly

The Short Iron Butterfly profits when the price of the underlying asset moves within a somewhat tight trading range.… Read the rest

Spotting the Trade in $AAPL $MSFT $SBUX w_/ Eric “The Wolfman” Wilkinson [07/28/21]

Swing Trades with Options -Sideways Moves- #1. The Short Iron Condor

The Short Iron Condor profits when the price of the underlying asset remains in a relatively tight trading range (or a market-neutral bias).… Read the rest