(Video) Swing Trades Using Options: #7. Synthetic Long

This Statistic Is Correct 80% Of The Time

If you’ve been a student of Steven Primo’s trading education you already know that he doesn’t follow statistics.… Read the rest

(Video) Steven Primo’s Will You Be Prepared To Trade When The Market Reverses?

Swing Trades With Options: #9. Long Call Diagonal

The Long Call Diagonal option strategy is a long(er) term option strategy that profits when the underlying Stock, ETF or Future increases in value.… Read the rest

Swing Trades With Options: #8. Long Call Calendar

The Long Call Calendar Option Strategy is a long(er) term option strategy that profits when the underlying stock or ETF increases in value.… Read the rest

Swing Trades With Options: #7. Synthetic Long

The Synthetic Long Option Strategy is a (very) Bullish option strategy that profits when the price of the underlying asset increases in value.… Read the rest

Will You Be Prepared To Trade When The Market Reverses?

Many trading methods work great until the market dramatically changes directions.… Read the rest

(Video) Introducing Steven Primo’s New 1-Day “DYNAMIC STOP COURSE”

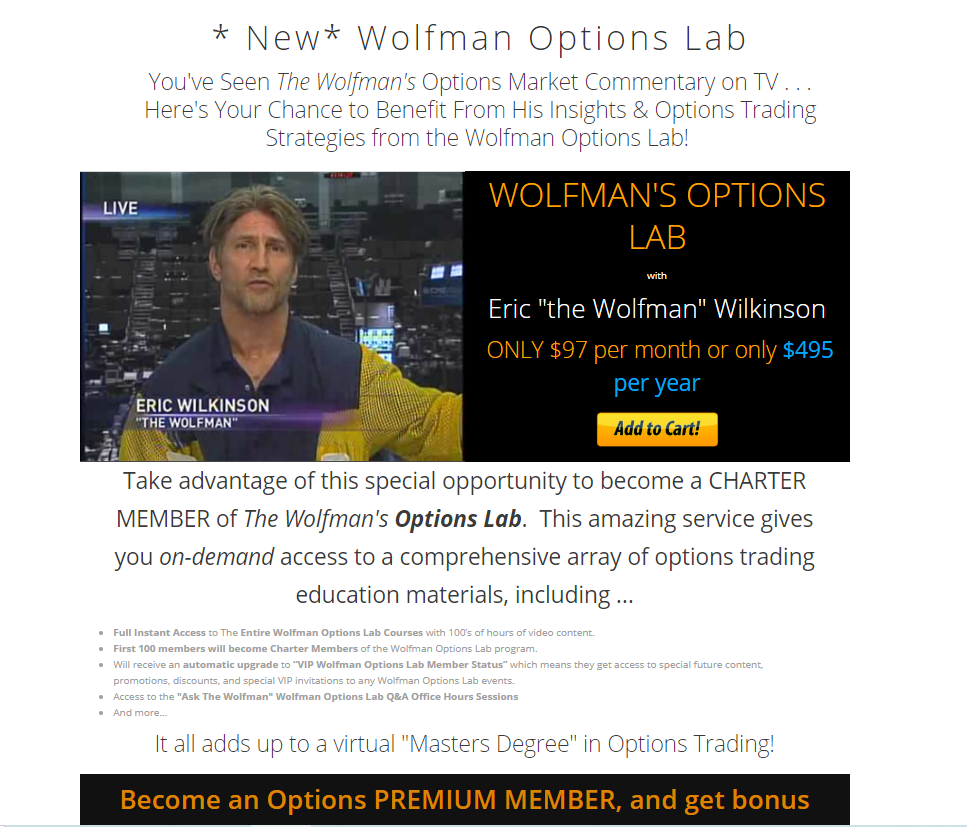

Wolfman’s Market Commentary for 04/30/21 $TWTR $AMZN

(Video) Swing Trades Using Options: #6. Short Put

Introducing Steven Primo’s New 1-Day “DYNAMIC STOP COURSE”

One of the most common statements we hear among new members is “My strategy generates signals just fine, but I get stopped out of the trade either too early or too late.… Read the rest

(Video) Steven Primo’s Buying & Selling “Shallow Pullback” Set-Ups

Swing Trades With Options: #6. Short Put

The Short Put is an options strategy that profits in many ways but when the price of the underlying asset increases in value (or a bullish move) is the quickest way to profit from the Short Put.… Read the rest

Buying & Selling “Shallow Pullback” Set-Ups

“Shallow Pullback” signals are high probability set-ups that appear over and over again in today’s markets.… Read the rest

(Video) Steven Primo’s Everything You Need To Know About Advanced Entries – Part 2

Wolfman’s Market Commentary for 04/23/21 $XXII

(Video) Swing Trades Using Options: #5. Bull Risk Reversal

(Video) Introducing Steven Primo’s New 2-Part “DYNAMIC STOP COURSE”

Swing Trades Using Options: #5. Bull Risk Reversal

The Bull Risk Reversal is an options strategy that profits when the price of the underlying asset increases in value (or a bullish move).… Read the rest

Introducing Steven Primo’s New 1-Day “DYNAMIC STOP COURSE”

One of the most common statements we hear among new members is “My strategy generates signals just fine, but I get stopped out of the trade either too early or too late.… Read the rest